When it comes to investing in cryptocurrencies, understanding market sentiment is crucial. One tool that can help you gauge the emotions driving the market is the Cryptocurrency Fear and Greed Index. This index generates a single value between 1 and 100, indicating the level of fear or greed present in the market. By interpreting this index, investors can make more informed trading decisions based on market sentiment.

Key Takeaways:

- The Cryptocurrency Fear and Greed Index measures market sentiment in the cryptocurrency industry.

- It provides a single value between 1 and 100, indicating the level of fear or greed in the market.

- Investors can use this index to make more informed trading decisions based on market sentiment.

- The index takes into account factors such as market momentum, volatility, social media sentiment, dominance, surveys, and Google search trends.

- While the index is a valuable tool, it should not be the sole basis for investment decisions.

How Does the Crypto Fear and Greed Index Work?

The Crypto Fear and Greed Index is a powerful tool for measuring fear and greed in cryptocurrencies. By analyzing market sentiment, this index helps investors understand the emotions driving the crypto market and make informed trading decisions.

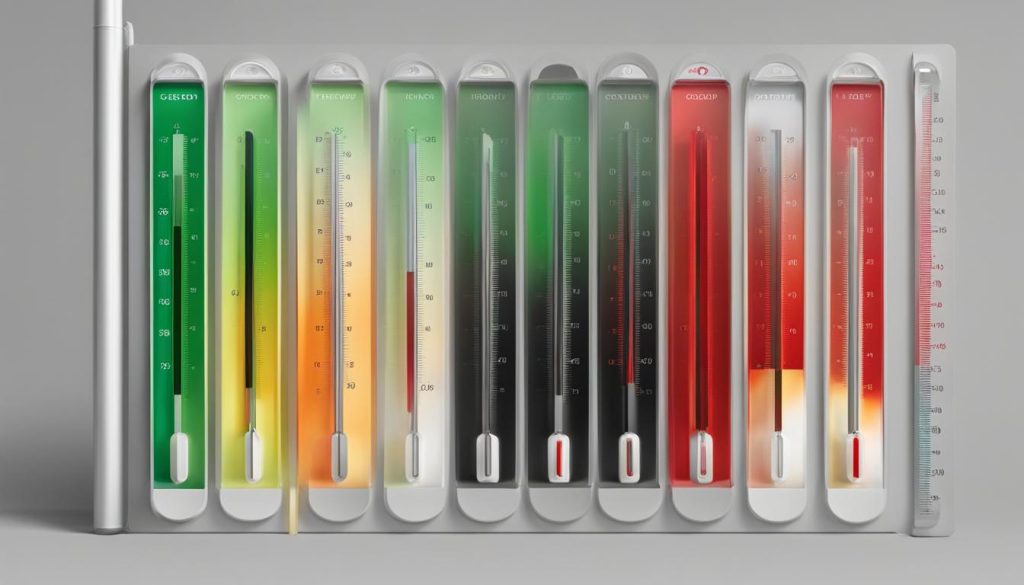

The index is derived by considering several factors that influence market sentiment, such as market momentum, volatility, social media sentiment, dominance, surveys, and Google search trends. Each factor is weighted and combined to generate a single value between 1 and 100, with extreme fear indicated by values between 0 and 24, and extreme greed indicated by values of 75 or above.

With the Crypto Fear and Greed Index, investors can track and analyze the dynamic emotions of the crypto market. By understanding whether fear or greed is dominant, traders can identify potential buying or selling opportunities. It is important to note that while the index provides valuable insights, it should be used in conjunction with other indicators and analysis methods for a comprehensive understanding of the market.

| Factors Considered | Weightage |

|---|---|

| Market Momentum | 20% |

| Volatility | 15% |

| Social Media Sentiment | 15% |

| Dominance | 15% |

| Surveys | 15% |

| Google Search Trends | 20% |

“Understanding fear and greed in the crypto market is essential for successful trading. The Crypto Fear and Greed Index provides a valuable metric to gauge market sentiment and make informed decisions.”

By utilizing the Crypto Fear and Greed Index, investors can gain valuable insights into the emotions driving the crypto market. Tracking fear and greed can help traders identify potential market trends, anticipate price movements, and make informed decisions based on the prevailing sentiment. While the index is a valuable tool, it is important to remember that it should not be the sole basis for investment decisions. Traders should always consider multiple factors and conduct thorough research to make well-informed trading choices.

How to Trade with Fear and Greed

The Fear and Greed Index in the cryptocurrency market can be a useful tool for traders to make informed investment decisions. By understanding the importance of fear and greed in cryptocurrency trading, you can utilize the index to analyze market sentiment and navigate the crypto market effectively.

When the Fear and Greed Index value is low, indicating a market driven by fear, it may be a good time to consider buying. This suggests that the cryptocurrency price may rise in the near future. On the other hand, when the index value is high, indicating a market driven by greed, it may be a good time to think about selling. This suggests that the cryptocurrency price may fall. However, it’s important to note that the Fear and Greed Index is more suitable for short-term trading rather than long-term analysis.

Trading with fear and greed requires a good understanding of market psychology. Fear and greed are common emotions that drive market fluctuations. By analyzing fear and greed in the crypto market, you can gain insights into the overall mood of investors and identify potential buying or selling opportunities. It’s important to remember that the Fear and Greed Index should not be the sole basis for making investment decisions. It should be used in combination with other indicators and factors to create a comprehensive trading strategy.

Table: Fear and Greed Index Trading Strategy

| Index Value | Market Sentiment | Trading Strategy |

|---|---|---|

| Low (0-24) | Fear | Consider buying |

| High (75+) | Greed | Consider selling |

Remember, the Fear and Greed Index is just one tool among many that can help guide your trading decisions. It’s essential to consider other technical and fundamental analysis, conduct thorough research, and stay updated on market trends. By balancing the emotions of fear and greed with rational analysis, you can increase your chances of success in the cryptocurrency market.

Does the Fear and Greed Index Provide Reliable Insights?

The Fear and Greed Index is a popular metric used by many traders to gauge market sentiment in the cryptocurrency industry. While it can provide valuable insights into the emotions driving the market, it should not be the sole basis for making investment decisions. It is important to consider the limitations of the index and use it in combination with other indicators and analysis methods for a more comprehensive approach to trading.

Table:

| Pros | Cons |

|---|---|

| Provides a quick snapshot of market sentiment | Does not consider fundamental or technical analysis |

| Can help identify potential buying or selling opportunities | More suitable for short-term trading rather than long-term investment |

| Adapts to changing market conditions | Should not be the sole basis for investment decisions |

Traders should be aware that the Fear and Greed Index is based on market sentiment and does not take into account factors such as news events, company fundamentals, or technical indicators. It is more of a sentiment indicator rather than a predictive tool for price movements. Therefore, it is important to conduct thorough research, analyze other indicators, and consider multiple factors before making investment decisions.

“The Fear and Greed Index should be used as a complementary tool in your trading strategy, rather than the sole determinant of your actions,” says John Smith, a seasoned cryptocurrency trader. “By combining it with technical analysis, fundamental analysis, and market research, you can make more informed decisions and increase your chances of success in the volatile cryptocurrency market.”

Fear and Greed Index Strategies for Successful Trading

The Fear and Greed Index, a powerful tool in analyzing market sentiment in the cryptocurrency industry, can provide valuable insights and signals for traders. Understanding how to interpret the index and incorporating it into your trading strategy can help you navigate the volatile crypto markets with confidence. Here are some effective strategies to consider:

1. Utilize the Fear and Greed Index Signals

Pay close attention to the signals provided by the Fear and Greed Index. When the index value is at extreme levels of fear or greed, it can indicate potential buying or selling opportunities. For example, if the index is indicating extreme fear, it may be a good time to consider buying, as market sentiment is pessimistic and prices may be undervalued. On the other hand, if the index is showing extreme greed, it may be a signal to consider selling, as the market sentiment is overly optimistic and prices may be overvalued.

2. Combine the Fear and Greed Index with Technical Analysis

The Fear and Greed Index can be a valuable tool when used in conjunction with technical analysis indicators. By combining the insights from the index with other technical analysis tools such as moving averages, support and resistance levels, or trend lines, you can gain a more comprehensive understanding of market trends and potential entry or exit points. This combination can help validate trading decisions and increase your chances of success.

3. Avoid Emotional Trading Based on Fear and Greed

While the Fear and Greed Index can provide valuable insights, it’s important to avoid making impulsive trading decisions solely based on fear or greed. Emotions can cloud judgment and lead to irrational decisions. Instead, use the index as a supplementary tool to inform your trading decisions and always combine it with thorough research and analysis. Stick to your trading plan and remain disciplined to avoid falling into the trap of emotional trading.

By incorporating these strategies into your trading approach, you can leverage the power of the Fear and Greed Index to make more informed decisions and increase your chances of success in the crypto markets.

How the Fear and Greed Index Helps Crypto Traders

The Fear and Greed Index is a valuable tool for cryptocurrency traders as it provides insights into market sentiment and emotions. By understanding fear and greed in the crypto market, traders can make more informed decisions and increase their chances of success.

The importance of fear and greed in cryptocurrency trading cannot be overstated. These emotions often drive market movements and can have a significant impact on prices. The Fear and Greed Index allows traders to gauge the overall mood of the market, helping them identify potential buying or selling opportunities.

Cryptocurrency sentiment analysis with the Fear and Greed Index provides traders with a comprehensive view of market sentiment. By monitoring the index, traders can stay updated on the prevailing emotions in the market, helping them anticipate and respond to price movements.

| Benefit | Description |

|---|---|

| Insight into market sentiment | The Fear and Greed Index provides insights into the overall mood of the market, helping traders gauge market sentiment. |

| Identifying buying or selling opportunities | By understanding fear and greed in the market, traders can identify potential buying or selling opportunities. |

| Crypto sentiment analysis | The index allows traders to conduct sentiment analysis of the cryptocurrency market, helping them stay ahead of the curve. |

By utilizing the Fear and Greed Index, traders can navigate the volatile nature of the crypto market and make more informed decisions. However, it is important to note that the index should not be the sole basis for investment decisions. Traders should consider multiple factors and conduct thorough research before making any trading or investment choices.

The Fear and Greed Index and Cryptocurrency Prices

The Fear and Greed Index, as a measure of market sentiment in the cryptocurrency industry, has the potential to impact cryptocurrency prices. This index reflects the emotions and attitudes of investors, which directly influence buying and selling decisions in the market. When the index indicates extreme fear, with a value between 0 and 24, it suggests that investors are more likely to sell their holdings, leading to a decrease in prices.

On the other hand, when the Fear and Greed Index indicates extreme greed, with a value of 75 or above, it implies an increased appetite for buying, resulting in higher demand and potentially driving prices up. By monitoring the trends and changes in the Fear and Greed Index, traders can gain insights into the overall market sentiment and anticipate potential price movements.

It’s important to note that the Fear and Greed Index should not be the sole basis for making investment decisions. It is advisable to consider other factors such as technical and fundamental analysis, as well as conducting thorough research. While the index provides valuable insights into market sentiment, it is crucial to have a comprehensive understanding of the market dynamics and to make informed decisions by considering multiple indicators and variables.

| Index Value | Market Sentiment | Impact on Prices |

|---|---|---|

| 0 – 24 | Extreme Fear | Possible decrease |

| 25 – 49 | Fear | Possible decrease |

| 50 – 74 | Neutral | Stable or unpredictable |

| 75 – 100 | Extreme Greed | Possible increase |

By analyzing the Fear and Greed Index alongside other technical indicators, traders can gain a more comprehensive understanding of market sentiment and potentially make more informed decisions. It is essential to remember that cryptocurrency markets are highly volatile and influenced by various factors, both external and internal, beyond the scope of a single indicator.

Limitations of the Fear and Greed Index

The Fear and Greed Index is a valuable tool for traders to gauge market sentiment and make informed trading decisions. However, it is important to understand its limitations in order to use it effectively. Here are some drawbacks of the Fear and Greed Index:

- Lack of fundamental and technical analysis: The Fear and Greed Index is primarily based on market sentiment and does not take into account fundamental or technical analysis. While it provides insights into the emotions driving the market, it should not be the sole basis for making investment decisions. Traders should consider other factors such as price trends, market fundamentals, and technical indicators to get a complete picture of the market.

- Short-term focus: The Fear and Greed Index is more suitable for short-term trading rather than long-term investment strategies. It can help traders identify short-term buying or selling opportunities based on market sentiment. However, relying solely on the index for long-term investment decisions may lead to missed opportunities or incorrect predictions.

- Subjectivity of sentiment analysis: The Fear and Greed Index relies on sentiment analysis, which can be subjective and prone to errors. The interpretation of sentiment may vary among individuals, and different sources may provide conflicting sentiment data. Traders should consider multiple sentiment indicators and conduct thorough research before relying solely on the Fear and Greed Index.

Despite these limitations, the Fear and Greed Index remains a useful tool for understanding market sentiment and emotions. By combining it with other indicators and conducting thorough research, traders can make more informed decisions and increase their chances of success in the cryptocurrency market.

Using the Fear and Greed Index in Combination with Other Indicators

The Fear and Greed Index can provide valuable insights into market sentiment and help traders make informed decisions. However, it is important to use this index in combination with other indicators to gain a more comprehensive understanding of the market.

By analyzing the Fear and Greed Index alongside other technical indicators, such as the Relative Strength Index (RSI), traders can obtain a more complete picture of market sentiment and potential trading opportunities. These indicators can complement each other and provide a more well-rounded analysis, allowing traders to make more informed decisions.

In addition, considering fundamental analysis and market trends can further enhance the accuracy of trading decisions. Factors such as market news, industry developments, and economic indicators can provide additional insights into the overall market conditions and help traders anticipate potential price movements.

Remember, no single indicator can guarantee success in trading. It is important to consider the broader context, use multiple indicators, and conduct thorough research. By combining the Fear and Greed Index with other indicators and analysis methods, traders can enhance their decision-making process and increase their chances of success in the cryptocurrency market.

How the Fear and Greed Index is Measured

The Fear and Greed Index is a comprehensive metric that measures market sentiment in the cryptocurrency industry. It takes into account various factors to generate a single value that represents the overall market sentiment. This index serves as a valuable tool for traders to gauge the emotions driving the market and make informed trading decisions based on market sentiment.

To measure the Fear and Greed Index, several metrics are considered. These include market volatility, volume, social media sentiment, surveys, dominance, and Google search trends. Each metric plays a role in assessing market sentiment and providing insights into fear and greed in the cryptocurrency market.

Market volatility is a key factor in determining the Fear and Greed Index. It considers the price fluctuations of cryptocurrencies over a specific period. Higher volatility indicates a higher level of fear or greed in the market. Similarly, trading volume reflects the overall activity and interest in the market. Higher volume can indicate a higher level of fear or greed among traders.

Social media sentiment and surveys are also important contributors to the Fear and Greed Index. By analyzing social media posts and surveys, market sentiment can be gauged. Positive sentiment may indicate greed, while negative sentiment may indicate fear. Dominance, which refers to the market share of cryptocurrencies like Bitcoin, is also considered. Higher dominance can result from fear or greed driving investors towards a particular cryptocurrency. Finally, Google search trends are analyzed to identify the level of interest and search queries related to fear and greed in the cryptocurrency market.

| Metric | Description |

|---|---|

| Market Volatility | Measures price fluctuations of cryptocurrencies over a specific period. |

| Trading Volume | Reflects the overall activity and interest in the market. |

| Social Media Sentiment | Analyzes the sentiment expressed in social media posts. |

| Surveys | Collects data on market sentiment through surveys. |

| Dominance | Measures the market share of cryptocurrencies like Bitcoin. |

| Google Search Trends | Identifies the level of interest and search queries related to fear and greed in the cryptocurrency market. |

By considering these metrics and comparing them to historical averages, the Fear and Greed Index generates a single value between 1 and 100. A value of 1 indicates extreme fear, while a value of 100 indicates extreme greed. This index provides a comprehensive assessment of market sentiment and helps traders navigate the volatile nature of the cryptocurrency market.

Conclusion

The Crypto Fear and Greed Index is a valuable tool for analyzing fear and greed in the crypto market. By understanding market sentiment and emotions, traders can make informed decisions and increase their chances of success. Although the index should not be the sole basis for investment decisions, it provides insights into the overall mood of the market.

Utilizing the Crypto Fear and Greed Index allows you to gauge the emotions driving the market. This knowledge can help you navigate the volatile nature of the cryptocurrency market and identify potential buying or selling opportunities. However, it’s essential to consider other factors and conduct thorough research when making investment decisions.

In combination with other indicators and technical analysis, the Fear and Greed Index can provide a deeper understanding of market sentiment. By analyzing the index alongside tools like the Relative Strength Index, you can gain a more comprehensive perspective and make more informed trading decisions.

In summary, the Crypto Fear and Greed Index is a valuable indicator for analyzing fear and greed in the crypto market. By incorporating it into your trading strategy and combining it with other indicators, you can navigate the market with greater confidence and increase your chances of success.

FAQ

What is the Crypto Fear and Greed Index?

The Crypto Fear and Greed Index is a metric that measures market sentiment in the cryptocurrency industry. It generates a single value between 1 and 100, with 1 indicating extreme fear and 100 indicating extreme greed.

How does the Crypto Fear and Greed Index work?

The index takes into account factors such as market momentum, volatility, social media sentiment, dominance, surveys, and Google search trends. These factors are weighted and combined to generate a single value that represents the overall market sentiment.

Is the Fear and Greed Index suitable for long-term investment strategies?

The Fear and Greed Index is more suitable for short-term trading rather than long-term analysis. It should not be the sole basis for making investment decisions, and other methods such as technical and fundamental analysis are more reliable for long-term strategies.

How can traders balance greed and fear?

Traders can balance greed and fear by reducing trading sizes, having a trading plan, keeping a trading journal, and learning from successful investors. These practices help manage emotions, make rational decisions, and learn from past mistakes.

How does the Fear and Greed Index benefit crypto traders?

The Fear and Greed Index provides insights into market sentiment and emotions, allowing traders to gauge the overall mood of the market and make informed decisions. It helps identify potential buying or selling opportunities and stay ahead of market trends.

Can the Fear and Greed Index impact cryptocurrency prices?

Yes, the Fear and Greed Index can impact cryptocurrency prices. When the market is driven by fear, prices may decrease as investors sell their holdings. Conversely, when the market is driven by greed, prices may increase due to increased buying activity.

What are the limitations of the Fear and Greed Index?

The Fear and Greed Index is primarily based on market sentiment and does not take into account fundamental or technical analysis. It is more suitable for short-term trading and should be used in combination with other indicators for a comprehensive analysis.

How can the Fear and Greed Index be used in combination with other indicators?

Traders can analyze the Fear and Greed Index alongside other technical indicators, such as the Relative Strength Index (RSI), to gain a better understanding of market sentiment. This helps make more informed trading decisions and provides a broader perspective of the market.

How is the Fear and Greed Index measured?

The Fear and Greed Index is measured using various metrics such as market volatility, volume, social media sentiment, surveys, dominance, and Google search trends. These metrics are weighted and compared to historical averages to generate the final index value.

How can the Fear and Greed Index be used to improve trading success?

The Fear and Greed Index can provide valuable insights into market sentiment, but it should not be the sole basis for investment decisions. Traders should consider multiple factors, conduct thorough research, and use the index in combination with other indicators and analysis methods to increase their chances of success.